Gold has long been considered a safe haven asset and a hedge against inflation. However, in recent years, gold has not performed as well as other investment options, leading many to question whether investing in gold is still a wise choice. Here are a few reasons why investing in gold may not be the best idea today:

Gold has underperformed compared to other assets

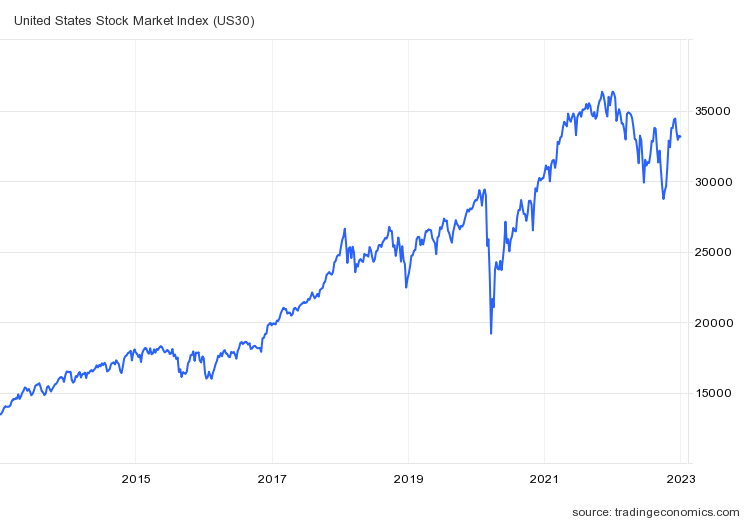

Over the past decade, gold has significantly underperformed compared to other assets such as stocks and real estate. According to data from the World Gold Council, the price of gold has only increased by about 20% since 2010, while the S&P 500 has increased by over 250%. This means that if you had invested in stocks instead of gold over the past decade, you would have seen a much higher return on your investment.

Gold does not provide income

Unlike stocks, which pay dividends, or real estate, which can generate rental income, gold does not provide any income. This means that if you invest in gold, you will not receive any regular payments or returns on your investment. This can make it difficult to generate a steady stream of income from gold, especially if you are relying on it as a main source of income.

Gold can be volatile

While gold is often seen as a safe haven asset, it can still be volatile and subject to significant price fluctuations. This can make it difficult to predict the future value of gold and can make it challenging to hold onto it for long periods of time.

Gold may not be as useful as other assets

While gold has been used as a form of currency for centuries, it may not be as useful as other assets in today's world. For example, stocks can provide a way to participate in the growth of companies, while real estate can provide a physical asset that can be rented out or used for personal use. Gold, on the other hand, may not have as many practical uses, making it less useful as an investment.

A brief overview of the gold price history over the past decade

- 2012: Gold prices started the year at around $1,600 per ounce and ended the year at around $1,700 per ounce.

- 2013: Gold prices started the year at around $1,700 per ounce and reached a high of around $1,800 in the first half of the year. However, prices then dropped to around $1,200 by the end of the year.

- 2014: Gold prices started the year at around $1,200 per ounce and ended the year at around $1,200 per ounce, with relatively little price movement throughout the year.

- 2015: Gold prices started the year at around $1,200 per ounce and ended the year at around $1,100 per ounce, with a slight decline in prices over the year.

- 2016: Gold prices started the year at around $1,100 per ounce and ended the year at around $1,150 per ounce, with a modest increase in prices over the year.

- 2017: Gold prices started the year at around $1,150 per ounce and reached a high of around $1,350 in the first half of the year. However, prices then dropped to around $1,250 by the end of the year.

- 2018: Gold prices started the year at around $1,250 per ounce and ended the year at around $1,200 per ounce, with a slight decline in prices over the year.

- 2019: Gold prices started the year at around $1,200 per ounce and ended the year at around $1,500 per ounce, with a significant increase in prices over the year.

- 2020: Gold prices started the year at around $1,500 per ounce and reached a high of around $2,000 in the first half of the year. However, prices then dropped to around $1,800 by the end of the year.

- 2021: Gold prices started the year at around $1,800 per ounce and ended the year at around $2,000 per ounce, with a modest increase in prices over the year.

It's worth noting that these are just rough estimates and that gold prices can fluctuate significantly over short periods of time.

Conclusion

In conclusion, investing in gold may not be the best idea today due to its underperformance compared to other assets, lack of income, volatility, and potentially limited usefulness. While gold may still have a place in a well-diversified investment portfolio, it may not be the most ideal investment option for everyone.

Frequently Asked Questions

What is gold used for?

Gold has a variety of uses, including as a form of currency, in jewelry and decorative items, and in electronic and medical devices.

How is gold mined?

Gold is typically mined through one of two methods: open-pit mining or underground mining. In open-pit mining, ore is extracted from the earth through large pits, while in underground mining, tunnels are dug deep into the earth to access the ore.

How is gold valued?

Gold is valued based on its rarity, beauty, and usefulness. The price of gold is determined by the global market and can fluctuate based on supply and demand.

How is gold stored?

Gold can be stored in a variety of ways, including in the form of bars, coins, or jewelry. It can also be stored in a safe deposit box or in a professional storage facility.

Is investing in gold a good idea?

The decision to invest in gold is a personal one and depends on an individual's financial goals and risk tolerance. Some people view gold as a safe haven asset, while others see it as a speculative investment. It is important to carefully consider the pros and cons of investing in gold before making a decision.

How can I buy gold?

There are several ways to buy gold, including through a brokerage firm, a gold dealer, or online. It is important to carefully research and compares different options before making a purchase.

Is gold a good hedge against inflation?

Some people view gold as a good hedge against inflation because its value tends to increase when the value of paper currencies decreases. However, gold is not a guaranteed hedge against inflation, and its value can fluctuate based on a variety of factors.

How much gold should I own?

The amount of gold that an individual should own is a personal decision and depends on their financial goals and risk tolerance. Some financial experts recommend having a small percentage of gold in a well-diversified investment portfolio as a hedge against inflation and economic uncertainty.

Can I invest in gold through my retirement account?

Yes, it is possible to invest in gold through certain types of retirement accounts, such as a gold IRA. A gold IRA is a self-directed individual retirement account that allows you to hold physical gold as part of your retirement portfolio.

Is gold a good investment for beginners?

Gold may not be the best investment option for beginners, as it can be volatile and subject to significant price fluctuations. It is important for beginners to carefully research and understand the risks associated with investing in gold before making a decision.

Can I sell gold back to the dealer?

Yes, it is possible to sell gold back to the dealer or to a gold refinery. However, it is important to keep in mind that the price you receive for your gold may be less than the original purchase price due to various fees and the fluctuating market value of gold.

How do I know if my gold is real?

There are several ways to test the authenticity of gold, including using a gold testing kit, taking it to a professional gold dealer or jeweler, or using a special instrument such as an X-ray fluorescence spectrometer.

Can I buy gold on margin?

Yes, it is possible to buy gold on margin, which means that you can borrow money from a broker to purchase gold. However, buying gold on margin carries additional risks, including the possibility of losing more money than you originally invested if the price of gold declines.

Is gold a good investment in a recession?

Gold is often considered a safe haven asset during times of economic uncertainty, such as during a recession. However, the performance of gold during a recession is not guaranteed, and its value can fluctuate based on a variety of factors.

Is it better to buy gold coins or bars?

The decision to buy gold coins or bars is a personal one and depends on your investment goals and preferences. Gold coins may be more collectible and have a higher premium due to their rarity, while gold bars may be more cost-effective and easier to store.

Can I buy gold online?

Yes, it is possible to buy gold online through a variety of platforms, including through a brokerage firm or a gold dealer. It is important to carefully research and compare different options before making a purchase to ensure that you are getting a fair price and dealing with a reputable seller.

Hi, I’m Durgesh Nayak, and I hold a Master’s degree in Commerce with over five years of experience in the banking sector. I am certified with JAIIB and CAIIB, which has given me a solid foundation in financial knowledge. For the past four years, I’ve been sharing my passion for finance through writing money and finance blogs.

My goal is to make complex financial topics accessible and actionable, helping you improve your personal finance, investment strategies, and overall financial planning.